"Kiwisaver has proven to be a life changer for a whole generation."

The advent of KiwiSaver means a whole generation will have retirement funds who would otherwise have been highly likely to retire with little or no savings.

It has also proved to be an enabler and pathway into home ownership.

It's important to choose who looks after your money

We work with a 2 different NZ owned KiwiSaver specialist providers, Generate KiwiSaver and NZ Funds KiwiSaver. They both have a particular focus on performance.

Make the effort. get the right type of fund for you. Use this easy questionaire to help you decide the type of fund to be in.

Make sure you use the correct tax rate. All KiwiSaver funds are "PIE's" or Portfolio Investment Entities. You must nominate the tax rate to use. See here for guidance.

Join Generate

What difference does it make who I go with?

Quite a lot!

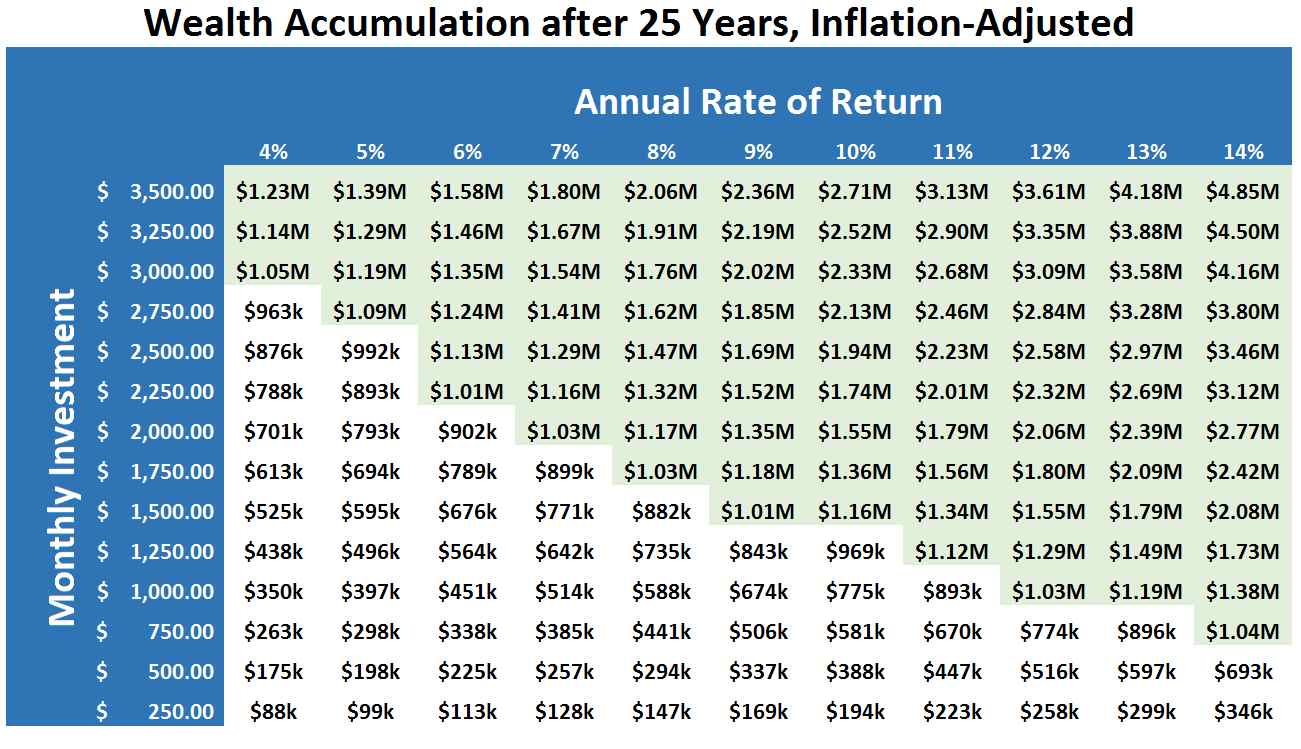

Different returns acheived can make a huge difference to you.

For instance a 35 year old on $50,000 per year contributing 6%, plus his employer's 3%

Let's say he has $20,000 in KiwiSaver by now.

An average net return only one percent higher over the next 30 years would mean $101,694 more to retire on